Learn all about the different budgeting techniques and which budget method is right for you and your family.

If you are starting out as a budgeting beginner, you will soon find that just getting started can be overwhelming, or at least that’s what we thought we when started our budgeting journey. The quicker you can get your budget together, the quicker you will be on track to conquer your financial goals!

Did you know that a Gallup poll found only about 1/3 of Americans (32%) maintain a household budget?

While many people tend to tweak these budget methods to their own liking, we are going to go over the most common budgeting techniques, how they work, pros and cons, and explain how to choose the right one.

Most Common Budgeting Techniques

Pay Yourself First: Reverse Budgeting

This type of budgeting is a little more relaxed and is intended to put money in your investments and savings first, then apply the rest of your budget to household expenses. Reverse budgeting is great for the person or couple who has a little less monthly debt and is really working towards savings, versus cutting down on monthly costs.

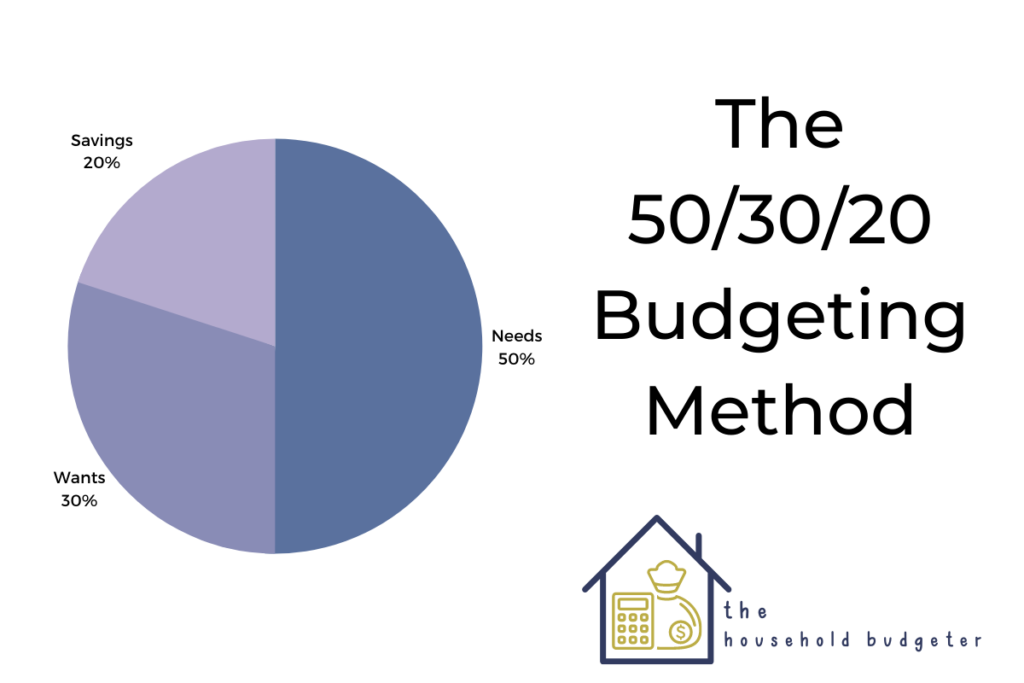

The 50/30/20 Method

The 50 – 30 – 20 technique is great for beginner budgeters who aren’t looking to track every single dollar. It’s a great way to build a budget and get a bird’s eye view of the bigger picture.

Here’s how the 50/30/20 budgeting method breaks down.

- 50% is budgeted for your needs.

- 30% is budgeted for your wants.

- 20% is budgeted towards savings and investments.

Seems easy enough right? The most difficult part of this budget is breaking apart your spending habits to actually define the difference between your wants and needs.

Zero Based Budgeting

Getting started with a zero-based budget is a little more time consuming but is a comprehensive method that tracks every single penny of your money. We find that this budget works best for those with a regular income schedule, who really want to buckle down on getting their debt under control, and is good for families as long as the people in charge are on the same page.

The idea of a zero-based budget is that you take your income and budget every dollar. So at the end of planning your budget, you should have $0 leftover. This doesn’t mean you spend all of your money and have none left in your bank account, it just means that every purchase has its place.

This method is also perfect for the person who is uber organized and a lot of self discipline.

Cash Envelope System

The budget envelope system is great especially when you find yourself overspending in certain categories all the time.

The idea of this budgeting technique is that you literally take cash and put it into envelopes, once it’s spent, it’s gone. See how that helps with overspending?

You simply form your budget then load your cash into each envelope category. Anytime you are out shopping, depending on the categories you have set up, you will pay with that cash and track it.

At the end of the month, if you have extra cash leftover, you can carry it over for the next month, or reallocate it to a different category.

This budget really keeps things in check because for whatever reason there is a psychological connection of physically handing over you money versus swiping a debit or credit card.

Also, if you are the sole budgeter in your family, this is a great budget method. It is a little harder to track if you have another spender involved.

Which is the best budgeting technique?

There is not a right or wrong answer to this question. You really need to test out which method would be better for you and find one you can actually stick with.

The first steps to any budget is knowing your monthly income and expenses.

Also review some of your old bank statements to see if there are areas you can scale back in and see which ones are really eating all of your budget.

If you are a real shopper and spend a lot of money on groceries and eating out, the cash envelope system would probably be best.

Want to really hone in on saving money and your monthly debt is pretty low? Reverse budgeting would probably work out better.

Just starting a looking to scale back a little bit on spending? Not overly organized and have multiple people spending from the same account? Your answer here would probably be the 50/30/20 method.

If you have a low monthly budget or you have set goals for savings and have a lot of debt, zero-based budgeting might work better for you.

Deciding on a Budgeting Method

Here are some action steps to take to move forward with your budget.

Decide on your budgeting technique

- Cash Envelope System

- 50/30/20 Method

- Zero Based Budget

- Pay Yourself First (Reverse Budgeting)

Review Monthly Statements

Look back at your last 3 months of bank statements and calculate your income and expenses. Decide which categories you will need for your budget.

Paper or Digital

Are you going to track your budget with pen or paper do you need an app? Here are some common budgeting apps if you are choosing the digital method.

- EveryDollar

- Mint

- GoodBudget

- YNAB

- Finance Software (Wave, Quickbooks, etc.)

Set A Date

Decide when your budgeting will start to take place and set aside some time to plan everything out. It’s much easier to stay on track when you have a plan in mind. Take an hour each week to review your budget then a couple of hours at the end of each month to review and get ready for the next month.

Which budgeting method have you found that works best for you and your family?

Pin for Later!